We’re all humans, and it’s tough to blame a well-known television show or a famous film for making a minor

Hollywood has been around long enough that some of the most famous and iconic actors and actresses have become a

Many people love to watch movies. It’s a popular form of entertainment that has been around for decades and is

Whether we like it or not, movies have effectively made their mark in society’s mainstream culture. From the smart Sci-Fi

Since its conception, actors have always been the focal point of all the attention in Hollywood. More often than not,

With all the glitz and glamour of Hollywood, actors have always been the focal point of all the attention. Most

People have their own job descriptions for things to run as smoothly as possible regardless of any given work environment.

It’s a tedious task to identify the musical cannons to which Beyonce, Ashlee Simpson, and Public Image Ltd. all belong.

If you love music, there is probably a list of songs and artists that you love. Most of the time,

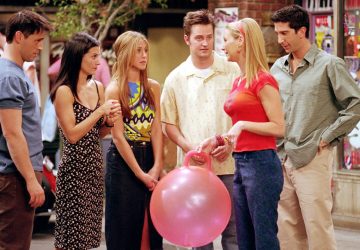

Friends What could have been, and who would it be, if Jennifer Aniston didn’t get the credit to play Rachel Green in

When you think about it, it’s easy to see why anyone would dream of becoming a huge Hollywood celebrity. I

Fans often say that being a celebrity is the best thing anyone can be in today’s society. Celebrities have all

If one made it to Hollywood, mountains of dollars could be earned in a short amount of time. Some of

We all have embarrassing moments in public. It’s that one time where you find yourself on the other side of

It’s a fact that celebrities are always under constant surveillance. Unfortunately, the attention and pressure can be too much for

Whether we like it or not, Hollywood films have effectively made their mark in society’s mainstream culture. From the smart Sci-Fi

You could say that being famous and one of Hollywood’s elite are things that most of us want. However, being

Enjoying the final product of films and TV shows is our great luxury as fans. However, for those aspiring filmmakers,

Los Angeles doesn’t just boast the best food in the country. It’s also the best town to spot celebrities. Spotting

Disney has always been one of the biggest figures in the entertainment industry for decades. With its millions of investments, it

When given the opportunity, almost everyone would treat themselves out for a drink or a meal or even both, especially

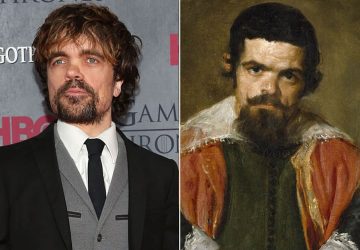

With more than seven billion people in the world today, there’s a big chance that we could bump into another

It looks like the photo app trends are continuously evolving, as it can now swap our looks to a different

There’s something about a good mystery, especially if it’s based on true life. The thrill and the rush of learning

There have undoubtedly been many moments where we watch with awe at certain movie scenes. In this list, we’ll look

The term “Netflix and chill” has grown popular over the past years because Netflix as a streaming service has become

Hundreds of television series are being released every year, giving audiences everything they need for pure entertainment. From drama to

Many of the celebrities today have a lot of look-alikes. It’s not really a big surprise. Celebrities are admired and

There are a lot of studies about having dogs. They say they can put your stress away no matter what

There’s no shortcut to achieving a healthy lifestyle. One must always watch his diet, do exercise, and maintain a good,